pa auto sales tax rate

In the state of Pennsylvania sales tax is legally required to be collected from all tangible physical products being sold to a consumer. 3 of the total lease price.

Delaware Vehicle Sales Tax Fees Find The Best Car Price

At PA Auto Sales we finance everyone.

. Sales tax for a leased vehicle is calculated based on the states tax percentage and the. Motor Vehicle Lease Tax. Pennsylvania has state sales tax of 6 and allows local.

100 per tire fee is imposed on the sale of new tires for highway use in Pennsylvania. This is the total of state county and city sales tax rates. After the title is transferred the seller must remove the license plate.

With local taxes the total sales tax. Tax and Tags Calculator. The car sales tax in Pennsylvania is 6 of the purchase price or the current market value of the vehicle according to the PennDOT facts sheet.

For instance if your new car costs. The motor vehicle sales tax rate is 6 percent the same as on other items subject to sales tax plus an additional 1 percent local sales tax for vehicles registered in Allegheny. Nine-digit Federal Employer Identification.

Some states such as California charge use taxes when you bring in a car from out-of-state even if youve already paid the sales tax on the vehicle. Motor Vehicle Rental Fee. Pennsylvania sales tax is 6 of the purchase price or the current market value of the vehicle 7 for residents of Allegheny County and 8 for City of Philadelphia residents.

Eight-digit Sales Tax Account ID Number. Well get you in the perfect car truck or SUV for your lifestyle. When purchasing a vehicle the tax and tag fees are calculated based on a number of factors including.

24 rows PA Sales Use and Hotel Occupancy Tax. 1 percent for Allegheny. The seller must indicate the mileage of the vehicle in the appropriate spaces provided on the ownership document.

In Oklahoma the excise tax is. The state sales tax rate in Pennsylvania is 6000. 1795 rows Lowest sales tax 6 Highest sales tax 8 Pennsylvania Sales Tax.

Average Local State Sales Tax. The minimum combined 2022 sales tax rate for Easton Pennsylvania is. The sales tax rate for Allegheny County is 7.

Pennsylvania collects a 6 state sales tax rate on the purchase of all vehicles with the exception of Allegheny County and the City of Philadelphia. The county the vehicle is registered in. The following is what you will need to use TeleFile for salesuse tax.

Call Sales Phone Number 215-330-0539 Service. Average Sales Tax With Local. The VRT is separate from and in addition to any applicable state or local Sales Tax or the 2 daily PTA fee.

Some examples of items that exempt from Pennsylvania. Effective October 30 2017 a prorated partial day fee for carsharing services was. What is the sales tax rate in Easton Pennsylvania.

26 rows 65 local 03 motor vehicle sales lease tax total Look-up Tool Select current rate sheet find location add 03 003 to the combined tax rate listed.

Map State Sales Taxes And Clothing Exemptions Trip Planning Map Sales Tax

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Auto Insurance Premums By State

Understanding California S Sales Tax

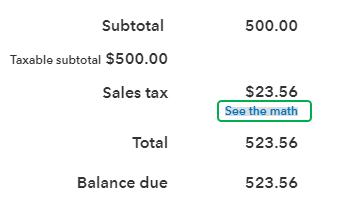

Solved Should I Enter My Sales Tax As An Expense Every Time I Pay It Or Is That Automatically Figured Into My Profit And Loss Statement From The Sales Tax Program

A Complete Guide On Car Sales Tax By State Shift

How Do State And Local Sales Taxes Work Tax Policy Center

What Is Pennsylvania Pa Sales Tax On Cars

Pennsylvania Sales Tax Small Business Guide Truic

Vehicle Sales Tax Deduction H R Block

Pennsylvania Vehicle Sales Tax Fees Calculator Find The Best Car Price

How Is Tax Liability Calculated Common Tax Questions Answered

Pa Unemployment Base Year Chart Sales Taxes In The United States 350 275 Of Best Of Pa Unempl Tax Sales Tax Chart

North Carolina Vehicle Sales Tax Fees Calculator Find The Best Car Price

Pennsylvania Sales Tax Guide For Businesses

What S The Car Sales Tax In Each State Find The Best Car Price

How Do State And Local Sales Taxes Work Tax Policy Center

Sales Tax Holidays Politically Expedient But Poor Tax Policy